1. Introduction: The Red Metal Reality in 2026

In 2026, the global manufacturing sector is facing a transformative shift. The rapid expansion of AI-driven data centers and green energy infrastructure has pushed demand for copper alloys to historic levels. Consequently, the fluctuating copper price is no longer just a raw material concern; it is a critical driver of total project overhead.

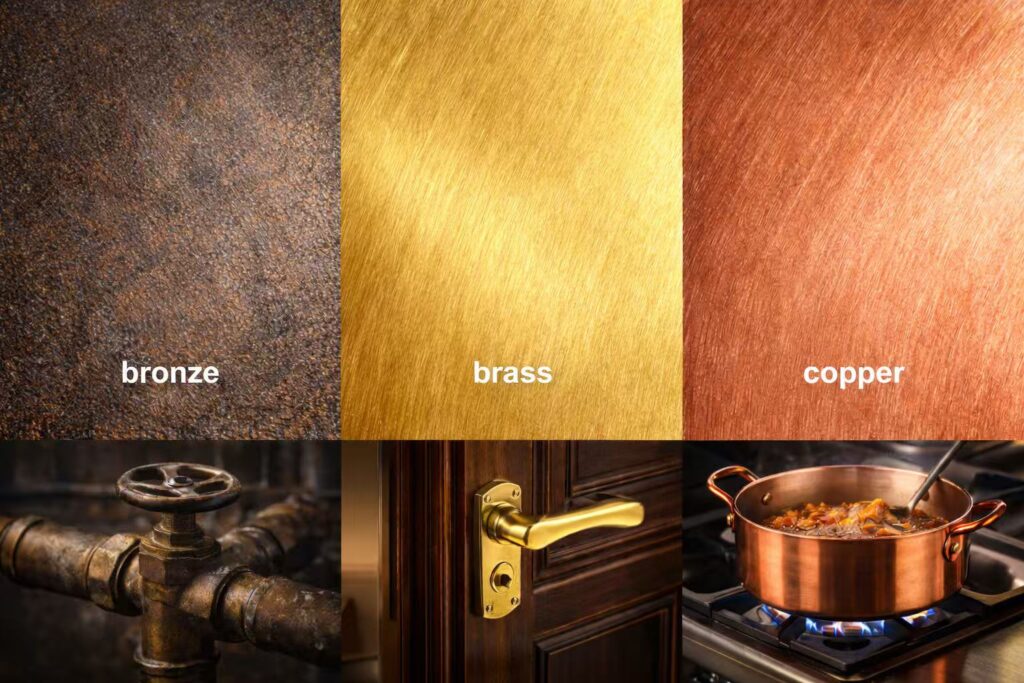

For procurement managers and engineers, distinguishing between bronze vs brass has evolved from a technical necessity into a strategic financial decision. As the market reacts to supply chain constraints, the volatility in brass price and bronze price can significantly impact the bottom line of any high-scale production.

This guide provides a focused three-way analysis of bronze vs brass vs copper. By evaluating the trade-offs in brass vs copper conductivity and the industrial durability of copper vs bronze, we offer a roadmap for making cost-effective material selections in today’s complex economic landscape.

2. Technical Deep Dive: Beyond Chemical Composition

Understanding the physical properties of these alloys is essential for optimizing performance while managing costs.

Bronze vs Brass

The primary distinction lies in the alloying element: Bronze is typically copper alloyed with tin, whereas brass is copper alloyed with zinc.

● Performance: Bronze is superior in corrosion resistance (especially in saltwater) and exhibits higher metal fatigue resistance. It is the go-to for heavy-duty bearings and marine hardware.

● Machinability: Brass is significantly easier to machine. Its low coefficient of friction and high ductility make it ideal for precision components, gears, and decorative valves where complex shaping is required.

While brass offers superior speed, bronze requires specialized techniques to handle its toughness. For detailed technical specs, see our Bronze Machining: A Comprehensive Guide. Conversely, if your project requires high-volume complexity, explore The Ultimate Guide to Custom Brass CNC Machining: Properties, Parts, and Precision Engineering to optimize your production.

Brass vs Copper

This comparison centers on the trade-off between pure conductivity and structural utility.

● Conductivity: Pure copper remains the gold standard for electrical applications.

● Structural Strength: Brass serves as a “strengthened copper.” While it sacrifices some conductivity, the addition of zinc increases hardness and strength, making it more suitable for mechanical connectors, fasteners, and plumbing fixtures that must withstand physical stress.

Copper vs Bronze

In heavy industrial and artistic sectors, the choice between these two depends on longevity and aesthetics.

● Industrial Durability: Bronze is far harder and more durable than pure copper, making it the preferred choice for heavy machinery bushings and industrial pumps.

● Oxidation & Patina: Pure copper oxidizes into a distinct green patina relatively quickly. Bronze also develops a protective patina, but its oxidation process is generally slower and results in a deeper, chocolate-brown finish, which is why it has been the standard for outdoor statuary for millennia.

3. The 2026 Price Mechanism: From Raw Material to Final Quote

In 2026, the cost of copper alloys is no longer a static figure but a dynamic response to global industrial demand. Understanding the “Red Metal Price Ladder” is crucial for managing procurement budgets.

The Copper Factor (Baseline Volatility)

While copper price is a highly competitive “headline” keyword, it serves as the gravitational center for all copper-based alloys. By early 2026, copper has breached the $12,000/mt mark due to the AI infrastructure boom. Manufacturers typically calculate quotes using a “Base Metal + Conversion Premium” model. This means that a 10% surge in copper price often translates into a 6–8% immediate increase in the price of semi-finished brass and bronze products.

Brass Price: The High-Value Utility

The brass price remains the most cost-effective option in the red metal family.

● The Zinc Offset: Because brass contains 30–40% zinc—which is significantly cheaper and more abundant than copper—it acts as a price buffer.

● Manufacturing ROI: The primary cost advantage of brass in 2026 isn’t just the material; it’s the machining efficiency. Its high chip-breakability reduces tool wear and cycle times, often making the “total part cost” lower than even cheaper raw materials like stainless steel.

Bronze Price: The Strategic Premium

In contrast, the bronze price has positioned this alloy as a “luxury” industrial material in 2026.

● The Tin Crisis: Bronze relies on tin, which has become a volatile strategic metal due to mining disruptions in Southeast Asia.

● Cost Realities: With bronze scrap values often trading $0.20–$0.40/lb higher than brass, it is reserved for mission-critical applications where its superior wear resistance justifies the 25–40% premium over brass components.

| 2026 Metal Cost & Sourcing Matrix | |||

| Material | Est. Price Range (2026) | Primary Cost Driver | Scrap Recovery Value |

| Pure Copper | $4.80 – $5.10 / lb | AI & Grid Infrastructure | Highest (95%+) |

| Bronze | $3.30 – $4.10 / lb | Tin Scarcity | High (80-85%) |

| Brass | $2.30 – $2.85 / lb | Zinc Stability | Moderate (60-75%) |

4. Macro-Economics: Why Are Metals So Expensive in 2026?

The surge in red metal costs is not a temporary spike but a structural shift driven by three primary global forces.

AI and the Energy Transition

In 2026, the traditional drivers of copper demand have been eclipsed by the AI infrastructure boom.

● Data Center Cooling: AI-focused data centers require 3x more power density than conventional cloud facilities. This has sparked a “copper grab” for high-capacity power distribution and advanced liquid-cooling piping systems.

● Grid Upgrades: Global efforts to connect renewable energy sites to urban centers have led to massive grid modernization projects, consuming vast quantities of copper wiring and leaving little surplus for general manufacturing.

Supply Chain Geopolitics

The concentration of raw material production in politically sensitive regions has introduced a “risk premium” to every quote.

● Chile and Peru Disruptions: These two nations account for nearly 40% of global copper output. In 2026, a combination of labor strikes, new environmental royalties, and permit delays has resulted in a global refined copper deficit of approximately 330,000 metric tons.

● The Tin Squeeze: Since bronze is alloyed with tin, the bronze price has been disproportionately affected by export bans and mining disruptions in Southeast Asia. This has transformed bronze into a high-priority strategic asset.

● Tariff Pressures: Emerging trade restrictions and a 25% universal duty on refined copper imports in certain regions have fragmented the market, causing regional price spikes and extended lead times.

Commodities as an Inflation Hedge

In the current macroeconomic regime of 2026, copper is no longer viewed as just a cyclical industrial commodity; it is a strategic alternative asset.

● Financial Inflow: Global funds are increasingly using copper and its alloys as a hedge against currency devaluation and geopolitical uncertainty. This speculative activity often keeps the copper price elevated even when physical demand in traditional sectors (like construction) remains tepid.

● Recycling Value: High inflation has also boosted the value of “urban mines.” The secondary market for scrap has become so competitive that it is now a primary factor in the pricing of new brass and bronze rods.

5. Strategic Sourcing: Winning in the Volatile 2026 Market

In a year where the copper price is driven by aggressive AI infrastructure and green energy transitions, procurement success depends on moving beyond “price-per-pound” thinking. To navigate the fluctuating brass price and bronze price, savvy buyers are adopting the following strategic sourcing pillars:

Diversified Supplier Ecosystem

Relying on a single source is a significant risk in 2026. By building a multi-vendor network, buyers can compare quotes, quality, and lead times in real-time. This competition ensures you aren’t locked into a single supplier’s premium, allowing for flexible switching if regional disruptions impact bronze vs brass availability.

Tiered Procurement and Flexible Replenishment

Sophisticated buyers utilize a 70/30 volume split. By securing 70% of anticipated needs through long-term agreements (LTAs) with core suppliers, you guarantee baseline supply. The remaining 30% is sourced through the spot market, allowing you to take advantage of temporary pullbacks in the copper price without the burden of excessive, high-cost inventory.

Financial Hedging and Index-Linked Contracts

To manage the high volatility of bronze vs brass vs copper, buyers use professional financial tools:

● Futures & Options: Engaging in the derivatives market to lock in future procurement costs.

● Index-Linking: Inserting clauses into contracts where prices adjust automatically based on a commodity index (e.g., LME + fabrication fee). This shares the risk and prevents suppliers from baking “uncertainty premiums” into their quotes.

Market Intelligence and Cost Breakdown Analysis

Success requires a deep dive into the Total Cost of Ownership (TCO).

● Active Monitoring: Keeping a pulse on macro-economic shifts and supply-demand ratios in the brass vs copper sector.

● Should-Cost Modeling: Understanding the exact cost components (raw material vs. processing) allows buyers to challenge unjustified price hikes and negotiate from a position of data-driven strength.

Collaborative Cost-Sharing and Contractual Clarity

When a price surge is unavoidable, a “win-win” negotiation is key.

● Shared Burden: Negotiating schemes where suppliers optimize production efficiency to reduce waste, while the buyer absorbs a portion of the material hike.

● Precise Terms: Defining clear price validity periods, adjustment triggers, and liability clauses to prevent disputes during sudden market spikes.

Material Substitution and R&D Innovation

The most effective way to beat a rising bronze price is to innovate away from it.

● Technical Optimization: Collaborating with R&D to find lower-cost alternatives with similar properties.

● The Pivot: Evaluating if a project can transition from **bronze vs brass** to a high-performance alloy with a lower copper-content ratio, or utilizing advanced coatings to reduce the need for expensive base metals.

6. Conclusion

Navigating the bronze vs brass vs copper landscape in 2026 requires a balance of technical expertise and macroeconomic foresight. While the copper price remains the primary driver of volatility, choosing the right alloy for the specific environment and leveraging the high scrap value of these materials will allow your business to maintain a competitive edge.